8 Business Plan Financial Template SampleTemplatess SampleTemplatess

Follow the step-by-step instructions below to design your financial fact finder template: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

Financial Planning Fact Finder Template The Human Tower

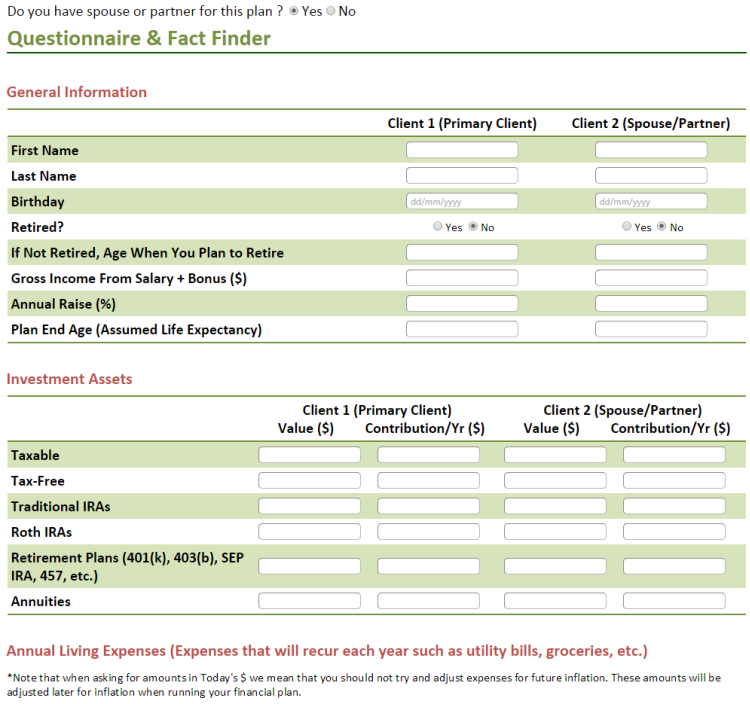

Raymond James is a financial services firm that helps you achieve a life well planned. To get started, download and fill out this client factfinder form, which will help us understand your goals, needs and preferences. Then, contact us to schedule a consultation.

8 Business Plan Financial Template SampleTemplatess SampleTemplatess

7. Forget the idea there is a 'right way' of doing a financial planning fact find. If we get the idea in our mind that there is a 'right way' to do a financial planning fact find then our mind will be occupied with evaluating how we think we are doing. So, forget this idea and allow the process to be natural, flowing, and intuitive. 8.

Financial Planning Infographic Facts

Complete Financial Planning Fact Finder Template 2020-2023 online with US Legal Forms. Easily fill out PDF blank, edit, and sign them. Save or instantly send your ready documents. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for.

50 Professional Financial Plan Templates [Personal & Business] ᐅ

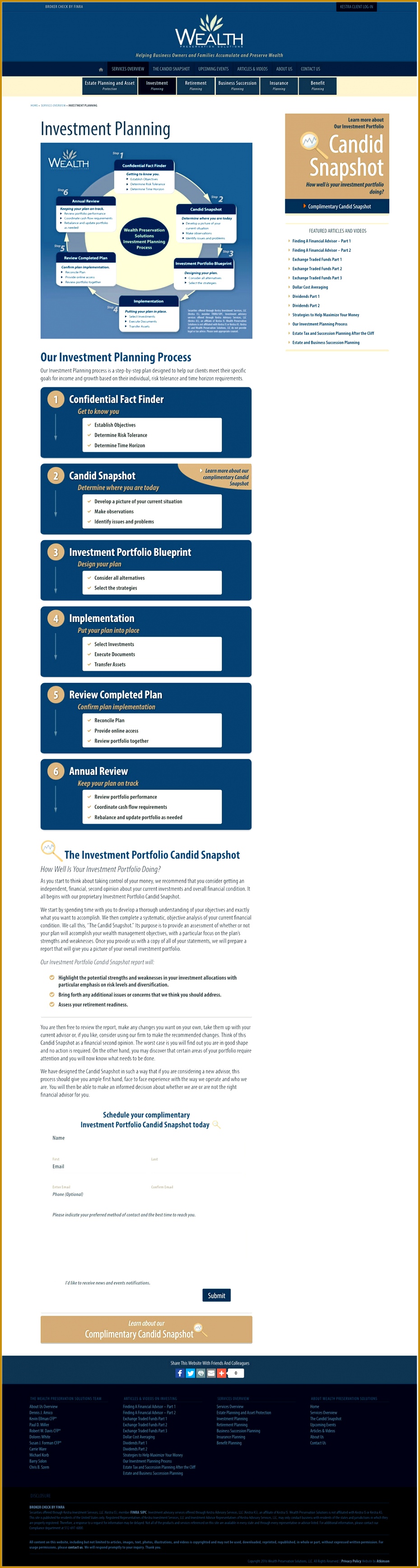

Data gathering for a comprehensive financial plan. The problem The fact finder conundrum. Every client is unique. Some are more tech savvy than others. Some don't even know where their financial documents are.. Create a specific template for a specific client, or split your data gathering process into several small steps over time. The.

6 Financial Planning Fact Finder Template FabTemplatez

Comprehensive Fact Finder for 1 Prepared by: Financial Brokerage, Inc. Gary Peterson, CLU, ChFC 2837 s 156 cir Omaha, NE 68130 Office: (402) 697-9998 Office: (800) 397-9999 [email protected]. Insurer or Service Type Plan Insured Benefits (Rm & Bd., Overall Max) Premium Amount and Mode Date of Issue Type Policy (Hosp., Major Med) Premium Payor

Financial Planning Fact Finder Template In Powerpoint And Google Slides Cpb

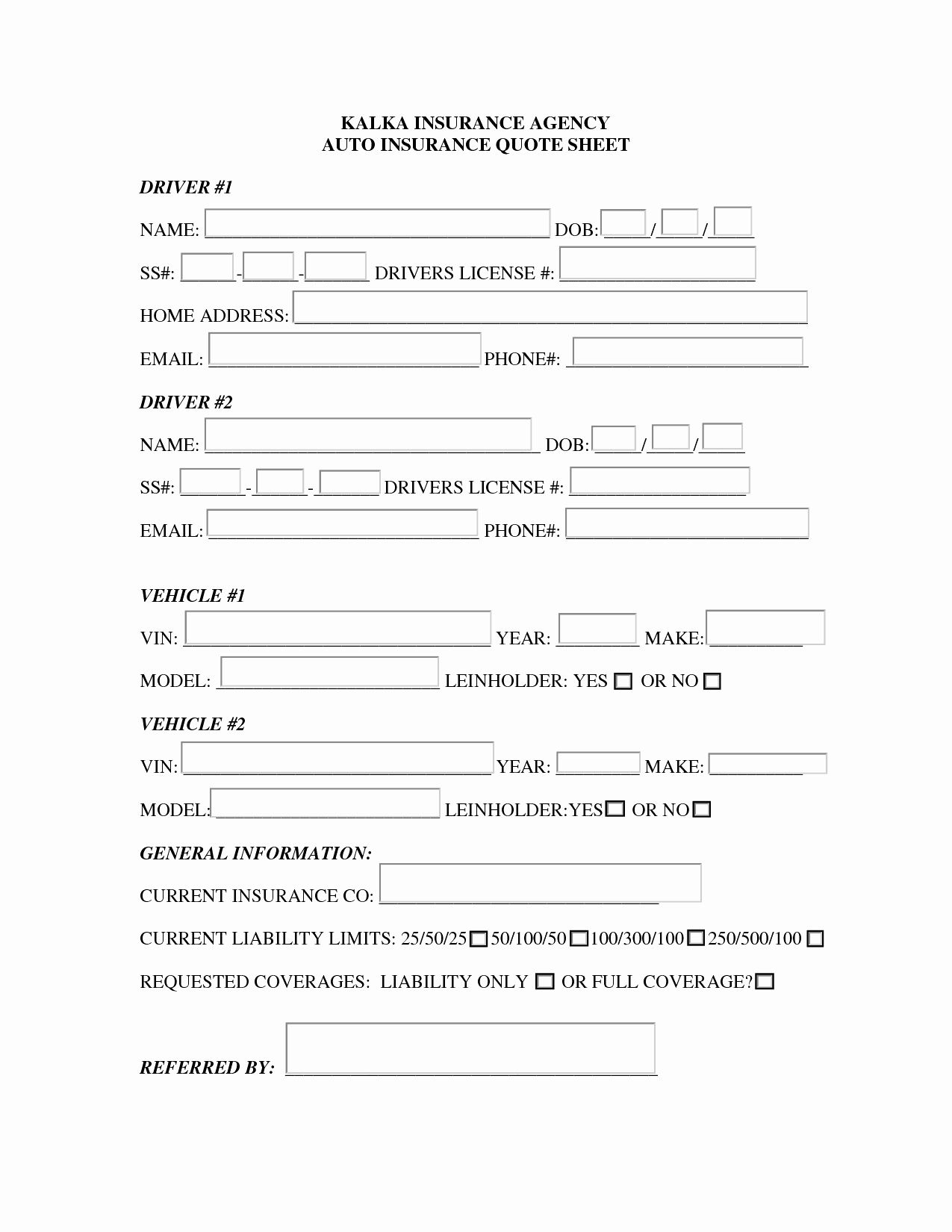

Prices and ordering information are at the bottom. AKA: Fact Finders, Client Discovery Tools, Data Collection Sheets, Risk Tolerance Questionnaires, Client Profile Tools, and Financial Discovery Tools. These financial plan tools are for financial advisors that want to do a much better job than fumbling around with a yellow pad during client.

3 Financial Planning Questionnaire Template FabTemplatez

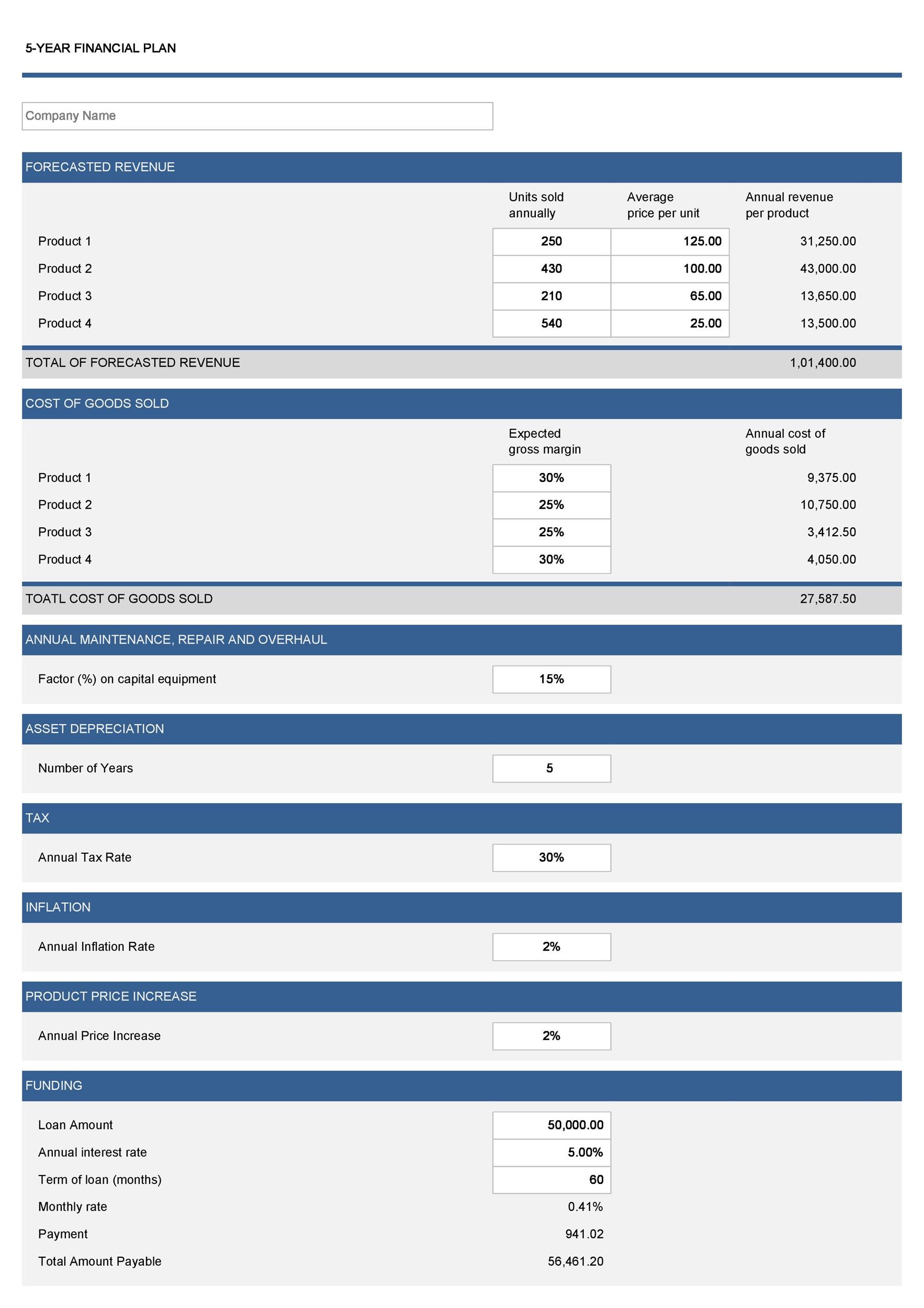

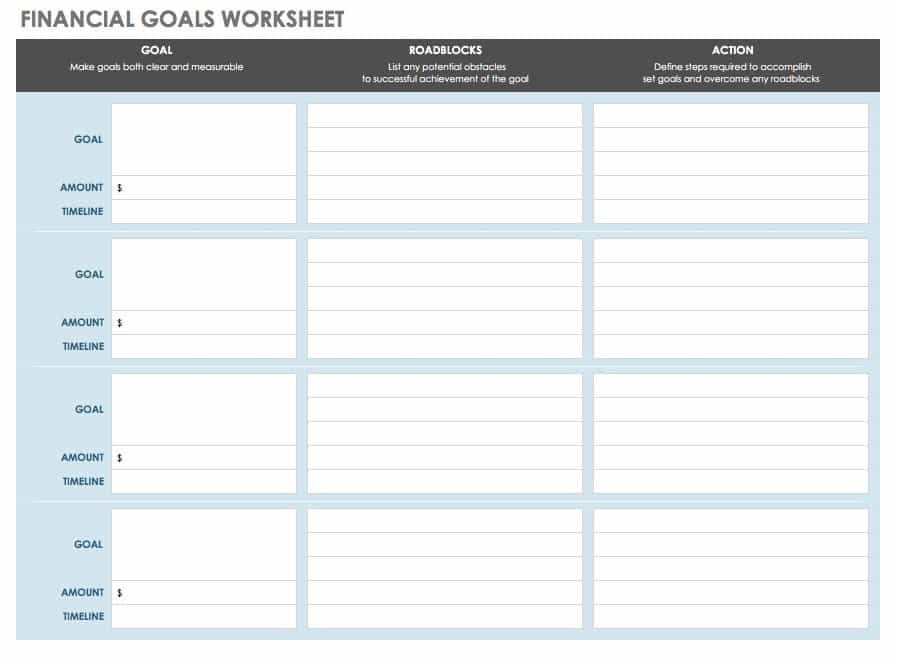

This one-page template allows you to create a personal financial plan that is concise yet comprehensive. Determine your current financial situation, create an action plan for reaching goals, and use the plan to track implementation and progress. If needed, you can include numbers for life insurance or estate planning.

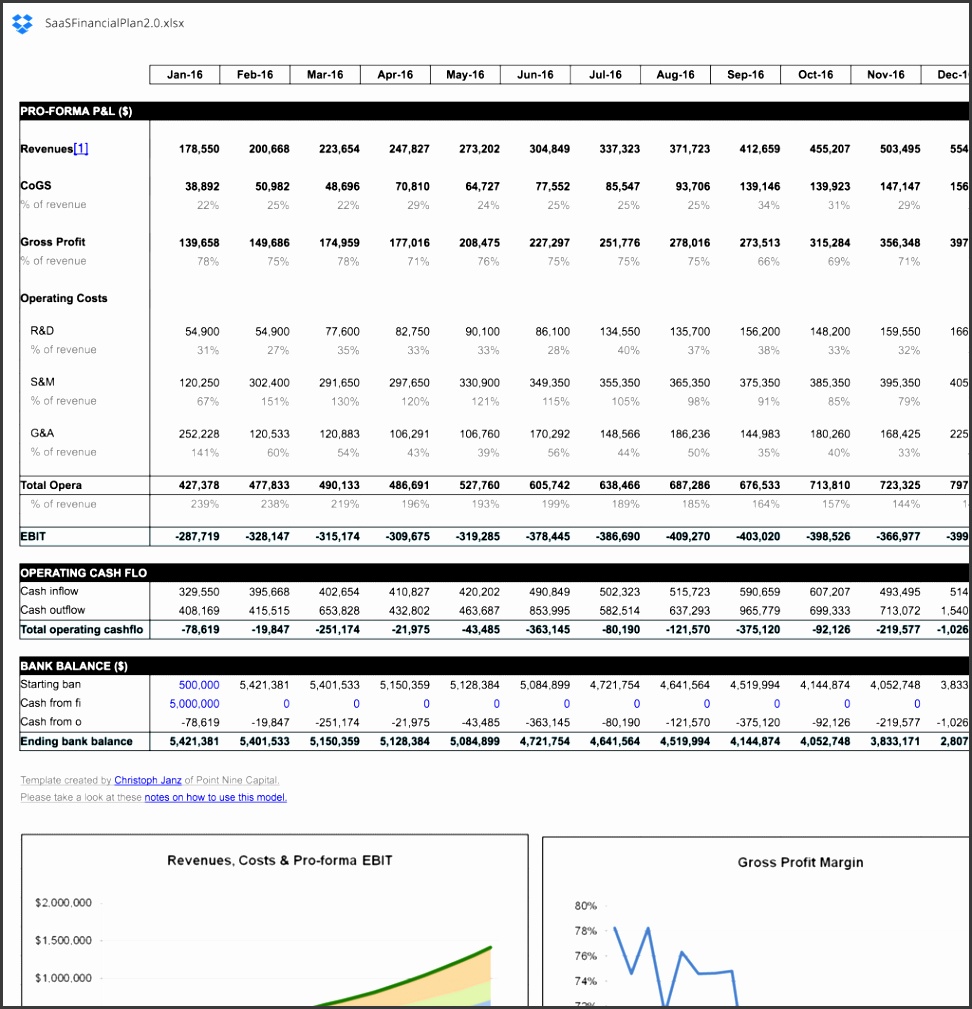

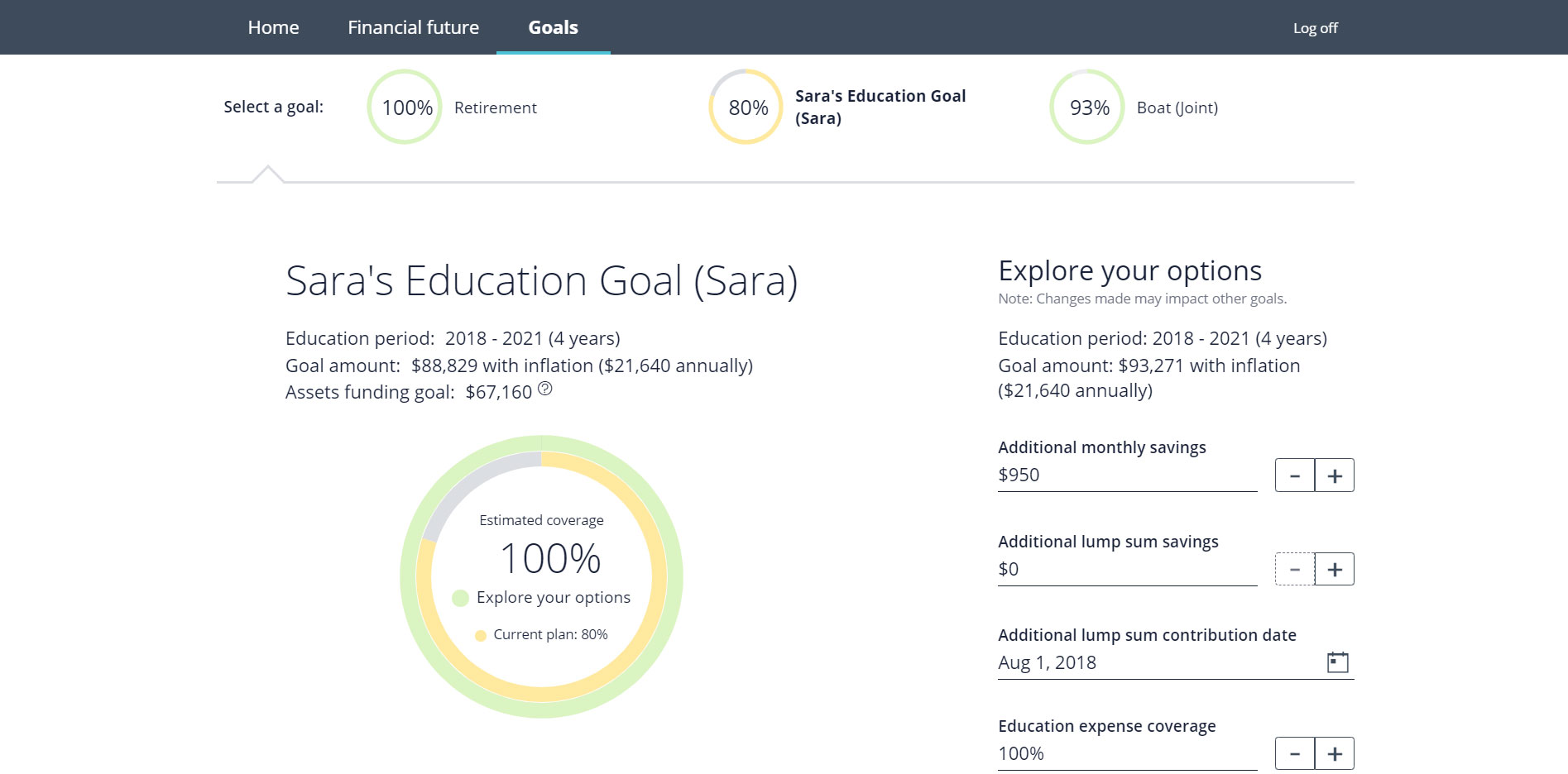

Sample Screenshots, Financial and Retirement Plans

Quick steps to complete and e-sign Financial planning fact finder pdf online: Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

Financial Planning Fact Finder Template 20202022 Fill and Sign Printable Template Online US

This fact finder is a 27 page questionnaire that is a comprehensive overview of your financial position and your priorities. In order for us to get the best possible picture of your financial situation, our advisors recommend reviewing and filling out this document prior to your first meeting.

Free Financial Planning Templates (2022)

FINANCIAL PLANNING QUESTIONNAIRE. The following documents will be needed for study and analysis as we work together to create a financial strategy for you. It is understood that this material will be treated confidentially and returned when the plan is completed, or earlier if requested. The following documents will be needed for study and.

Digital financial planning fact finder NaviPlan by InvestCloud

Fact Finder annual planning tools help financial professionals to guide client discussions pertaining to their current financial picture and assist in planning and achieving goals. [email protected]; 888-998-6521; Toggle. setting the expectations from the beginning. These tools are great resources for financial advisors to conduct discovery.

Fact Finder

How to fill out financial planning fact finder: 01. Start by gathering all relevant financial information, such as income, expenses, assets, and liabilities. 02. Provide personal details like your name, contact information, and social security number, if necessary. 03.

Financial Plan Template Word Unique 12 Financial Planning Fact Finder Template Iyuye Financial

Use our Financial Fact Finder as-is, or customize it to your firm's needs. Your clients will gladly do all the data input work, since they want to provide you with as much quality data as possible. After all, it's their financial future that your helping them plan for! . Also, did you know that PreciseFP templates can be pre-filled with data.

Estate Planning Worksheet Pdf

Every month, the CFP Board Report brings together CFP Board news, activities, policies and upcoming events to help CFP® professionals stay up to date.. Subscribe to CFP Board's Newsletter. The Let's Make a Plan newsletter provides consumer alerts, financial planning tools and resources, many of which offer topical information for discussing with your clients.

Fact Finder

Implementing the financial plan is a crucial step towards achieving the client's financial goals. This task involves taking action on the strategies and recommendations outlined in the plan. It may include opening investment accounts, reallocating assets, initiating tax-saving strategies, or setting up retirement plans.